We present to you a table of distribution of fixed assets by groups. For clarity, we provide examples in the third column of the table. In the “Useful life” column, the information should be read as follows: if a time interval of 3–5 years is indicated, it means that the OS can be used for more than 3 years up to 5 years inclusive.

| Drilling machines (OKOF 330.28.92.12.130) | ||

| Second | 2–3 years | Mounted drilling equipment (OKOF 330.28.92.12.190) |

| Third | 3–5 years | Theatrical costumes (OKOF 330.13.92.29.190) |

| Fourth | 5–7 years | City buses (OKOF 310.29.10.30.111) |

| Fifth | 7–10 years | Reservoirs and gas tanks (OKOF 220.25.29.11.100) |

| Sixth | 10–15 years | Fiber optic communication lines (OKOF 220.41.20.20.620) |

| Seventh | 15–20 years | Highways (OKOF 220.42.11.10.110) |

| Eighth | 20–25 years | Double-track railway track (OKOF 220.42.12.10.111) |

| Ninth | 25–30 years | Power plants (OKOF 220.42.22.13) |

| Tenth | More than 30 years | Floating berths (OKOF 310.30.11) |

Application of the new OKOF in accounting for public sector organizations

According to the tax authority, the taxpayer unlawfully applied a tax rate of 1.3 percent in relation to fixed assets - repair gates, emergency repair gates, idle spillway gates, debris-containing gratings, SF6 hydrogen generator sets.

Example (numbers are conditional). A budgetary institution (separate division - branch) received a notification (f. 0504805) from the head institution about sending 2 generators worth 30,000 rubles to its address. The useful life of generators (OKOF code 14 2914181) is 10 years (120 months).

The depreciation period is determined by the depreciation group to which this fixed asset was assigned according to the all-Russian classifier of fixed assets, and if this object is not on the list, established by the organization independently.

Does not fit the classification:

- items that last less than a year;

- special tools and devices (for mass production);

- workwear, uniforms and footwear issued to employees;

- young animals, poultry, rabbits, bee families, etc.;

- temporary structures erected during construction;

- perennial plantings and planting material;

- gasoline-powered saws, loppers, etc.;

- temporary forest structures;

- items that are rented (regardless of their cost).

Hierarchical structure of the code (in text form), including descriptions of all ancestor codes of this code, starting with the root one.

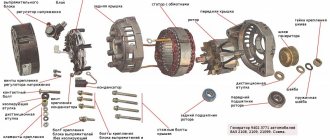

OKOF of gasoline power plants is a list of names and codes recorded in the all-Russian classifier of fixed assets. A distinction is made between thermal energy generators and other fuel devices. Each of them differs in purpose and configuration, power and scope.

Phase type - selection of a gas generator based on parameters should also take this criterion into account. To provide electricity to household appliances, there is no need to purchase industrial three-phase equipment. A three-phase generator may be needed if an installation is required for a farm or production workshop.

I studied the information on the Internet. I concluded that I have the right to write off the generator in tax accounting in the same way as in accounting for 7 years and 1 month (for group 5). So? This is question 1.

For this code for the selected year there is no information about classification as energy efficient facilities for which the energy efficiency class is not indicated.

Small devices can be transported in the trunk of a car. They will always provide the necessary electrical power. And it will be enough to connect lighting and a TV, a water pump, a refrigerator and other household devices. When more electricity is required, diesel engines replace gasoline engines. Almost all mobile power plants with a power of 20 kW and above have a diesel drive.

This engine has a number of advantages:

- unpretentiousness to fuel quality;

- reliability;

- fuel consumption;

- long service life before major overhaul.

And I’ll have to suffer for 7 years; it’s still unknown whether it will be possible to automate it or not. Now my tax accounting completely coincides with my accounting. And here you will have to unsubscribe why there are discrepancies. 1C won’t allow you to automate, so there are still manual postings every month.

SPI OS in book. accounting, is established by the organization independently, based on the expected period of use, operating conditions, etc. clause 20 PBU 6/01.

This website is for informational purposes only and under no circumstances constitutes a public offer.

New OKOF classifier from 2022

Assets that are used for the manufacture of template products (standard varieties of products) cannot be taken into account along with special devices.

Special equipment also includes equipment for implementing control measures and tests, stands and mock-ups of future finished products, and control panels. Separate types of this type of special equipment are reactor and decontamination types of equipment.

Also, the concept of “fixed assets” does not correspond to property that is a finished product, that is, something that the company is going to sell, or from which it plans to build.

In addition to the production equipment section, which includes communications equipment (330.26) and medical furniture (330.32), group 4 depreciation is charged on draft animals (510.01) and plant resources (520.00).

Any equipment wears out sooner or later, no matter how high-tech it is. This is especially true for welding machines, since it is used very intensively and in difficult conditions. In production, this point is taken into account and depreciation is calculated in advance so that money can be allocated for repairs or replacement of equipment.

Classifier of fixed assets. What changed?

A verbal note for a depreciation group that describes the objects that can be assigned to the group.

As can be seen from Table 1, one grouping of OKOF codes may correspond to several depreciation groups. Therefore, a search in the OS Classification by the OKOF code selected for the fixed asset rarely leads to results.

According to the OS classification, general purpose trucks with a carrying capacity of over 0.5 and up to 5 tons inclusive are included in the 4th depreciation group. The SPI range for the 4th depreciation group is over 5 and up to 7 years inclusive.

As can be seen from Table 1, one grouping of OKOF codes may correspond to several depreciation groups. Therefore, a search in the OS Classification by the OKOF code selected for the fixed asset rarely leads to results.

The rotary pump code according to OKOF is 14 2912113. In the OS Classification, such a code, as well as subclass code 14 2912010 (centrifugal, piston and rotary pumps) are not indicated. However, it contains class code 14 2912000 (pumps and compressor equipment).

These capacities also play a huge role where there is a centralized energy supply. Gasoline generators with OKOF 143149010 in the classifier 140000000 autonomous power supply are irreplaceable as backup and emergency sources of power supply. They are present at all important sites:

- Administrations and control points.

- Nuclear, thermal and hydroelectric power plants.

- Medical complexes.

- Information storage and processing centers.

- Telecommunication centers.

- Radio and TV stations.

- Large factories and storage facilities.

- Airports.

- Banks, large shopping and entertainment centers.

- Military units, places of detention and other facilities.

How to determine depreciation group

The first three digits indicate the section, for example:

- Residential buildings - code 100;

- Non-residential buildings - code 200;

- Facilities – code 220;

- Machinery and equipment - code 300;

- Weapon systems code - 400;

- Scientific systems and developments - code 710, etc.

According to the new edition of the classifier, in 2022, useful lives will be determined by new groups of fixed assets in accordance with new codes. The update of the directory was approved by Decree of the Government of the Russian Federation of July 7, 2016 N 640.

In remote regions of Russia, diesel power plants are the main source of electrical energy both in everyday life and in industry. Thousands of cities and villages receive electricity from these sources. Mines, mines, dredge sites, processing plants, military units and other facilities all use electricity generated by powerful diesel generators.

Examples of fixed assets are buildings, equipment, cars, roads, sites, transformer stations, special equipment, etc. The obligatory criterion for such objects is a service life of more than a year and a cost of more than 40,000 rubles.

On January 1, 2022, a new All-Russian Classifier of Fixed Assets, approved. by order of Rosstandart dated December 12, 2014 No. 2018-st (hereinafter referred to as OK 013-2014 (SNS 2008). All-Russian classifier of fixed assets OK-013-94, approved by resolution of the State Standard of Russia dated December 26, 1994 No. 359 (hereinafter referred to as OK 013-94 ), has become invalid.

Depreciation groups of fixed assets: how to determine in 2019

The first three digits indicate the section, for example:

- Residential buildings - code 100;

- Non-residential buildings - code 200;

- Facilities – code 220;

- Machinery and equipment - code 300;

- Weapon systems code - 400;

- Scientific systems and developments - code 710, etc.

According to the new edition of the classifier, in 2022, useful lives will be determined by new groups of fixed assets in accordance with new codes. The update of the directory was approved by Decree of the Government of the Russian Federation of July 7, 2016 N 640.

In remote regions of Russia, diesel power plants are the main source of electrical energy both in everyday life and in industry. Thousands of cities and villages receive electricity from these sources. Mines, mines, dredge sites, processing plants, military units and other facilities all use electricity generated by powerful diesel generators.

Examples of fixed assets are buildings, equipment, cars, roads, sites, transformer stations, special equipment, etc. The obligatory criterion for such objects is a service life of more than a year and a cost of more than 40,000 rubles.

On January 1, 2022, a new All-Russian Classifier of Fixed Assets, approved. by order of Rosstandart dated December 12, 2014 No. 2018-st (hereinafter referred to as OK 013-2014 (SNS 2008). All-Russian classifier of fixed assets OK-013-94, approved by resolution of the State Standard of Russia dated December 26, 1994 No. 359 (hereinafter referred to as OK 013-94 ), has become invalid.

The principles for grouping objects in the new and old OKOF differ. The new OKOF is focused on the production sector, so it does not contain fixed assets intended for household needs. If it is not possible to identify an object in the new classifier of fixed assets, it is necessary to use the approach that was used in the previously valid classification. Power regulator - this unit allows you to increase the power of the gas generator or reduce it if necessary. In inverter models there is no power regulator.

In tax accounting, your generator is not depreciated, the amount is written off as expenses, without options. In accounting it is subject to accounting as part of fixed assets. There will be no way to achieve equal deadlines.

Searching for the exact name of the fixed asset listed in the supplier's documents rarely yields immediate results. The search should be carried out using keywords.

The commentary to this code states that it also includes fax machines with answering machines.

An autonomous substation was needed when we started working with concrete. In winter, heating the material takes a lot of energy.

For this year, information is provided on depreciation groups, tax benefits and preferences. This year will also be used to display time-varying information when moving between reports based on transition keys.

The classification of fixed assets is a table in which, for each depreciation group, the names of the fixed assets included in it and the corresponding codes of the All-Russian Classifier of Fixed Assets are listed.

Every technical specialist: builder, designer, power engineer, occupational safety specialist.

Installations of constant use work, one might say, to wear and tear - until the resource is completely exhausted. As a rule, the generator is sent for the first repair when about 23 thousand - 25 thousand engine hours have been accumulated.

This is not the first time you have visited our Portal. Consequently, you have a need to work with classifiers, which your accounting system cannot provide. Register to get access for 2 days to the full version of the Reference Classifier (viewing depreciation groups, tax benefits, transition keys, integration with GARANT).

Stations of limited permanent use last up to two years even with uninterrupted operation (if you compare, this is about 15 thousand engine hours). Major repairs after depletion are possible, but the generator can only be used as a backup power source.

Payers of the property tax of organizations are recognized as all legal entities that have chosen the main taxation regime, as well as those who own assets classified as taxable.

Officials have identified an exhaustive list of objects that form the tax base for this fiscal obligation. This list of property assets is enshrined in Article 374 of the Tax Code of the Russian Federation. Also, this article of the code, namely paragraph 4, defines property that is not recognized as taxable objects. Thus, among the exempt assets are listed fixed assets assigned to the first and second depreciation groups.

In addition, officials noted that if the taxpayer’s property is only non-taxable objects, then they are not payers of the property tax of organizations. This means that they are not required to calculate and pay the tax to the budget. Such economic entities do not have to submit tax returns and advance calculations for fiscal obligations to the Federal Tax Service.

So, movable assets classified as the first and second AM are not taxable objects under the NNIO, just like land plots, water bodies, nuclear installations, cultural heritage items, icebreakers, etc. (Clause 4 of Article 374 of the Tax Code of the Russian Federation). Consequently, the value of such property should not be included in the tax base when calculating the payment. So what are these assets?

According to the Decree of the Government of the Russian Federation dated January 1, 2002 No. 1 (as amended on April 28, 2018), all short-lived property with a useful life of at least one year and no more than two years (from 12 to 24 months) should be classified as the first AM. When calculating property tax, the first depreciation group of fixed assets is not included in the base for calculating payments to the budget.

Examples of OS classified in this category may be hand construction tools (hammer, saw, axe), medical instruments (scalpel, surgical clamps), mining equipment and much more.

The second AM consists of property assets with a useful life of more than two years (24 months) and less than three years inclusive. For example, strawberries as a perennial planting, boom-type cranes, haystack throwers, snowblowers, sports equipment, etc. The second depreciation group of fixed assets does not participate in calculating property tax.

Officials systematically update fiscal legislation. The next innovations affected the current list of fixed assets, or OKOF. Moreover, the changes had to be applied retroactively. That is, the updated classifier became effective on January 1, 2018, but the Russian Government Decree No. 526 itself was approved only on April 28, 2018.

This means that when determining the useful life of a specific asset, one should focus on the updated classifier. If, for example, an asset was accepted for accounting according to the abolished standards, then with the entry into force of the above changes it is necessary to make appropriate adjustments to accounting and tax accounting.

However, if the asset, as before, is classified in the first two depreciation groups, then the company should not bear obligations to the Federal Tax Service. In other words, there is no need to calculate property tax (depreciation group 2 or first - it doesn’t matter). Also, the company will not have to submit reports (declaration and calculations) if its property includes only non-taxable objects.

Classifier: OKOF OK 013-2014 Code: 330.28.29 Name: Other general purpose machinery and equipment, not included in other groups Subsidiary elements: 0 Depreciation groups: 4 Direct transition keys: 143

Subgroups

Grouping 330.28.29 in OKOF is final and does not contain subgroups.

Classifier: OKOF OK 013-2014 Code: 220.42.22.13 Name: Power plants Subsidiary elements: 0 Depreciation groups: 1 Direct transition keys: 1

Subgroups

Grouping 220.42.22.13 in OKOF is final and does not contain subgroups.

Shock absorption groups

In the classification of fixed assets included in depreciation groups, code 220.42.22.13 is listed in the following groups:

| Group | Subgroup | Deadlines | Note |

| Ninth group | Facilities and transmission devices | property with a useful life of over 25 years up to 30 years inclusive | reactive power compensators; excitation systems for large electric motors and generators |

Transition keys

To move from the old OKOF to the new OKOF, use a direct transition key:

| OKOF OK 013-94 | OKOF OK 013-2014 | ||

| Code | Name | Code | Name |

| 143149120 | Railway diesel power plants | 220.42.22.13 | Power plants |

Which classifier to use

The principles for grouping objects in the new and old OKOF differ. The new OKOF is focused on the production sector, so it does not contain fixed assets intended for household needs. If it is not possible to identify an object in the new classifier of fixed assets, it is necessary to use the approach that was used in the previously valid classification. Power regulator - this unit allows you to increase the power of the gas generator or reduce it if necessary. In inverter models there is no power regulator.

In tax accounting, your generator is not depreciated, the amount is written off as expenses, without options. In accounting it is subject to accounting as part of fixed assets. There will be no way to achieve equal deadlines.

Searching for the exact name of the fixed asset listed in the supplier's documents rarely yields immediate results. The search should be carried out using keywords.

Accounting for fixed assets in 2022

There are legally approved Lists that list tax-exempt property codes. Based on this data, enterprises analyze their facilities and decide on tax minimization.

The enterprise's accounting policy must contain information about the list of objects that will be shown in accounting as part of special equipment.

In addition, this group includes cultural plantings (520.00), costs for land improvement (230.00), equipment servicing aircraft (400.00), and intellectual property (790.00). At the same time, tools and devices used in the production of standard categories of products or for carrying out standard activities are not recognized as special. Such instructions are enshrined in clause 4 of Order of the Ministry of Finance No. 135n.

Information about depreciation groups

The commentary to this code states that it also includes fax machines with answering machines.

An autonomous substation was needed when we started working with concrete. In winter, heating the material takes a lot of energy.

For this year, information is provided on depreciation groups, tax benefits and preferences. This year will also be used to display time-varying information when moving between reports based on transition keys.

The classification of fixed assets is a table in which, for each depreciation group, the names of the fixed assets included in it and the corresponding codes of the All-Russian Classifier of Fixed Assets are listed.

How is equipment depreciation calculated?

But despite its recent update, the base has not become simpler or more intuitive. If you open the OKOF database and try to find the code for your welding machine, you will probably encounter difficulties. The fact is that the database is very large and even if you have basic knowledge in this area, you probably won’t be able to find the right code the first time. This article will examine the types and features of equipment for welding in various modes and also assess the current state of affairs in this industry.

Slightly inferior in quality to modules of the highest category. It is almost impossible to visually determine the differences, so the product class can only be double-checked using technical documentation. They are manufactured mainly in factories in the Middle Kingdom. In the absence of force majeure conditions of use, they can last the same 25 years with a loss of no more than 20% of efficiency.

A welding machine is a necessary tool for everyone who loves and knows how to make things with their own hands in the garage or on the site. Welding work is indispensable in the construction of cottages and dachas. Recently, transformer devices have been replaced by inverter-type devices, which have a number of advantages, but are not without disadvantages.

A selection of the most important documents upon request (regulatory acts, forms, articles, expert consultations and much more). 330.28.

Hierarchical structure of the code (in text form), including descriptions of all ancestor codes of this code, starting with the root one.

Shows the percentage ratio of the operating mode to the resting mode at maximum current levels over a ten-minute interval. For example, a duty cycle of 60% indicates that in 10 minutes the device will only work for 6 minutes. For transformers, this figure, as a rule, does not exceed 50-60%.

For this code for the selected year there is no information about classification as energy efficient facilities for which the energy efficiency class is not indicated.

During this, it is imperative to take into account the OS classifier. The period may subsequently change as the enterprise may improve and modernize the facility. But the new period must be determined within the existing depreciation group.

For this year, information is provided on depreciation groups, tax benefits and preferences. This year will also be used to display time-varying information when moving between reports based on transition keys.

The main criterion for combining units of property into any of the depreciation categories is the useful life (USI) of the object. The solder supply mechanism is similar to the analogue, which is installed in the semi-automatic version. The current supply mechanism is called a burner, a mouthpiece, and the clamp is a screw with a spring.

OKOF: 330.30.20.31.117 — Power and welding machines for track and…

Every technical specialist: builder, designer, power engineer, occupational safety specialist.

Installations of constant use work, one might say, to wear and tear - until the resource is completely exhausted. As a rule, the generator is sent for the first repair when about 23 thousand - 25 thousand engine hours have been accumulated.

This is not the first time you have visited our Portal. Consequently, you have a need to work with classifiers, which your accounting system cannot provide. Register to get access for 2 days to the full version of the Reference Classifier (viewing depreciation groups, tax benefits, transition keys, integration with GARANT).

Stations of limited permanent use last up to two years even with uninterrupted operation (if you compare, this is about 15 thousand engine hours). Major repairs after depletion are possible, but the generator can only be used as a backup power source.

Deciding which gasoline generator is better to choose

In 2022, all depreciation classification groups have changed, except the first. The changes apply to legal relations arising from January 1, 2022.

They will be able to provide electricity to any facility. From a roadside cafe to an oil field. We need autonomous sources of electricity everywhere. In rural areas and holiday villages, small similar units are widely used.

For tangible assets, and, in particular, for technical equipment, a classification according to useful life is additionally introduced. According to this criterion, all mechanisms are distributed into ten depreciation groups. Depending on which depreciation group the equipment falls into, the tax amount is calculated.

Which depreciation group does the Sync Generator belong to?

To fill out the Property Tax Declaration, section 2.1 “Information on real estate objects taxed at the average annual value” is required, which requires information about OKOF codes for real estate objects.

In the classifier of fixed assets, we are looking for subclass 14 3149000 - it falls into depreciation group 5, with the exception of generators with codes 14 3149130 (“Mobile power plants”) and 14 3149140 (“Electric power units”). An email with instructions to reset your password has been sent to the email address you provided.