If it is necessary to weld seams with defects or weld metal structures made of steel, welders use coated electrodes and an inverter that produces direct current. Tungsten electrodes are also often used in welding stainless steel. Regardless of the chosen electrode or welder model, the problem of correct and quick ignition of the arc often arises. To solve this problem, just connect a welding oscillator to the equipment chain.

In this article we will tell you what an oscillator is in combination with other welding equipment, what the principle of operation is and how to use it in your work.

general information

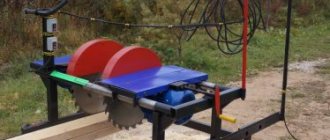

A welding oscillator for welding aluminum or any other metal is a device that generates high frequency current. Thanks to this current, the electrode interacts better with the metal surface. To use the oscillator you need a welding machine and an electrode holder. In this case, the oscillator is installed between them. The most famous oscillator models: OSSD 300 and OSSD 400, OP 240, OP 400.

In general, such devices operate on the following principle: the oscillator generates a short-term electrical pulse, igniting an arc. The pulse disappears immediately after ignition of the arc. In this case, there is no need for physical contact between the electrode and the metal surface. From the outside, this impulse looks like a small lightning bolt between the end of the electrode and the surface to be welded. By the way, you can make an oscillator yourself.

Basic signals supplied by oscillators

Despite their relative simplicity, oscillator-type indicators can provide a trader with a whole range of signals. Most oscillators are characterized by the following four types:

- Entry of the oscillator line into overbought and oversold zones;

- The oscillator line crosses the zero level;

- Divergence of the oscillator line with the price chart;

- Mutual intersection of the fast and slow lines of the oscillator.

In addition, another way to use them is to search for technical analysis figures (drawn by the oscillator line in its window).

Let's take a closer look at each of the above signal types.

Oscillator crossing overbought and oversold lines

This signal can perhaps be called classic for all oscillator-type indicators. Its essence is quite simple and lies in the fact that entering the oversold zone indicates that the market is satiated with the number of sales and, as a consequence of this, that a price increase is planned. On the contrary, if the oscillator is in the overbought zone, it tells the trader that the market is already so saturated with the financial instrument being analyzed that there is a high probability that its price will soon go down.

Each type of oscillator has its own recommended oversold and overbought levels (usually their values are 20 and 80%, respectively). However, I personally recommend adjusting these levels, both for each individual financial instrument and for the market conditions existing at that particular point in time. Always remember that there are no universal indicator settings.

The signal is usually considered the moment the oscillator leaves the corresponding zone. For example, leaving the overbought zone will indicate that the market, having become saturated with the volume of purchases, turns around and goes down (the price of the analyzed financial instrument falls) - this is a signal to sell. And vice versa, the exit of the oscillator from the oversold zone will indicate an upward price reversal, which is, accordingly, a signal to buy.

There is one important nuance here. You can never reliably say that the oscillator has finally left a particular zone. At any moment in time, the tip of the oscillator drawn by the trading terminal, which was looking beyond the border of the zone, can go back. This state of affairs is due to the calculation methodology, because the oscillator, which is essentially nothing more than a function of the price chart, is built using prices for a certain time interval.

The boundaries of this interval may vary depending on the current settings. More precisely, only its far border can differ, which determines the number of chart candles that will be taken into account when constructing the oscillator line. And the other border is almost always tied to the current moment in time. This means that sharp price jumps can greatly influence the position of the very tip of the drawn oscillator line.

Zero crossing

This signal can be called additional. That is, its presence, to a greater extent, allows the trader to establish himself in the reliability of the decision made the day before, rather than making a transaction based on it. This is explained mainly by the fact that by the time it appears, the price has sometimes already completed most of the movement in its current direction.

However, with certain settings, in some trading systems, these signals (albeit in combination with signals from other technical analysis indicators) are accepted as primary.

The interpretation of the signals is quite simple:

- Crossing the zero line from bottom to top is a signal to buy;

- Crossing the zero line from top to bottom is a signal to sell.

The figure below shows an example based on the Stochastic oscillator:

Oscillator divergence and prices

These kinds of signals are rightfully considered one of the strongest. And they consist in the fact that the price and indicator charts show a clear discrepancy between each other. For example, on the price chart there are two successively ascending maximums, and the oscillator chart, at the same time, draws the second maximum not higher (as on the price one), but lower than the first. See the example in the picture below:

The same can be said about a situation where two successively lower lows on the price chart are accompanied by two successively higher lows in the oscillator window.

This kind of divergence tells the trader that the real price potential does not correspond to the pattern it leaves on the chart. In the case when the price draws successively upward highs, and the oscillator does not “pull” the second high above the first, there is a clear lack of growth potential. And the consequence of this shortage will most likely be a return of the price to its “fair” values.

And when, on the contrary, the low of the oscillator does not want to repeat the corresponding low of the price (diverges from it, appearing not lower, but higher than the first drawn low), this indicates that the price cannot fall further, and therefore with a high degree of probability it should be expected turn up.

The issue of divergences is difficult to cover in a couple of paragraphs. There are a whole host of nuances and subtleties that should be taken into account when looking for this kind of discrepancy. For more information about divergence and the rules for its use, read the article: What is divergence and how to use it in trading.

Mutual intersection of oscillator lines

The chart of many oscillators is based on not one, but several lines. As a rule, these are the so-called fast and slow lines. The relative position and intersection of these lines also gives the trader signals to buy or sell.

When both lines of the oscillator are directed upward and, at the same time, the fast one crosses the slow one from the bottom up, then this is a signal to buy.

When, on the contrary, both lines are directed downwards, and the fast one crosses the slow one from top to bottom, then this is already a signal to sell.

In the case when intersections of this kind are repeated over and over again and the direction of the lines (meaning up or down) remains unchanged, it is customary to say that the signal sent in this way is amplified. Also, we can talk about signal amplification in the case when both lines, continuing their movement, cross the zero level.

Device

Most oscillators presented in stores have a similar structure and consist of a rectifier, capacitors (which accumulate charge), a power source, a separate unit (responsible for generating an electrical pulse) with an oscillating circuit and a spark gap, a control unit, a voltage sensor and a step-up transformer. Argon models also have a gas valve.

Welding process sequence

Despite some differences in the assembly, the use of devices of this class follows the same scenario. You can imagine the sequence of operation of the device like this:

- The welder on the torch presses the “Start” button.

- The rectifier at the input receives voltage from the network, rectifies it and sends it to the storage device.

- The storage unit is charging.

- After the storage capacitor is triggered, the pulse is released.

- The pulse enters a high-frequency transformer and is converted into a high-voltage pulse.

- At the same time, the gas valve is activated and argon comes out of the argon-containing chamber.

- After a short discharge of current, the arc is ignited in the gas cloud and the welding process begins.

- When the welding current begins to work with a force exceeding five amperes, the pulse fades. The welding process takes place with the values set on the machine. When contact is lost, the next impulse occurs to revive the arc.

- When welding ends, the device ends the process.

When making an argon burner with your own hands, the design can be simplified and the device becomes semi-automatic. In this case, if the welding process is accidentally completed, you must manually turn on the non-contact ignition by pressing the “Start” button.

Principle of operation

The device not only generates an electrical impulse, it changes the incoming voltage, increasing its frequency and voltage. This whole process takes a second. Let's take a closer look at the principle of operation of the oscillator.

First, the electrical circuit is started by pressing the torch button. The rectifier equalizes the incoming current, transforming it into a unidirectional state. The current is then stored in capacitors. Subsequently, the current is released and enters the oscillating circuit. This is where the voltage increases. If the device is intended for argon welding, then the gas valve opens at the same time.

The same impulse is formed, which in appearance resembles lightning. It connects the end of the electrode and the surface of the metal being welded. The ground cable is pre-connected to the metal. That's all! A welding machine included in this circuit allows parts to be welded. And the welding oscillator (for example, model OSSD 300 or OP 240, OP 400) ensures stable arc burning.

Rules for operating oscillators

The use of an oscillator for welding aluminum, other non-ferrous metals or stainless steel requires compliance with a number of simple rules that will make working with such a device comfortable and safe.

- Oscillators can be used both indoors and outdoors.

- It is not recommended to use welding oscillators outdoors if it is raining or snowing outside.

- It is allowed to work with such devices at ambient temperatures from –10 to +40 degrees Celsius.

- It is permissible to use oscillators at ambient humidity levels not exceeding 98%.

- The atmospheric pressure at which such devices can be used must be in the range of 85–106 kilopascals.

- It is not recommended to use such a device in rooms where the atmosphere is heavily polluted with dust, caustic vapors and gases that can destroy insulation and metal.

- You can start working with the welding oscillator only if it is reliably grounded.

- Before starting work, you should always check whether the device is correctly connected to the welding circuit and whether its contacts are working properly.

- The oscillator casing must always be put on during welding work; it can only be removed when the device is disconnected from the electrical network.

- The working surface of the spark gap must always be kept clean and free of carbon deposits. If carbon deposits appear, it must be removed using sandpaper.

You can not only buy such a device, which will help you weld non-ferrous metals and stainless steel, but also make it yourself.

Peculiarities

There are several types of oscillators and they are all used for specific tasks. But we'll start with the characteristics that all types of oscillators have in common. So, all devices are capable of converting current up to 5000V and increasing the frequency up to 500 kHz.

Now about the differences. There is an oscillator for welding aluminum or any other metal that runs continuously. Thanks to continuous action, a stable arc is ensured. Most modern devices sold in stores belong to this type. This type of oscillator should be connected in series to avoid excessive voltage that could cause you harm. Remember to follow safety precautions in the workplace. With the help of such devices, you can weld using a low current value and easily ignite the arc. Often such an oscillator is installed on a welding inverter or transformer to work with coated electrodes.

There are also oscillators for non-contact excitation of the arc when welding using argon machines. They differ in that they have a gas valve. Typically, argon welding is performed using tungsten electrodes, which can often become dull when ignited using the tapping method. Because of this, the seam turns out to be sloppy and uneven, and the arc burns unstable. You can, of course, continually sharpen the electrode, but we still recommend using an oscillator.

Pros and cons of oscillators

The main advantages of oscillator-type indicators include such inherent characteristics as:

1.Easy to use. Indeed, oscillators always show fairly clear and well-interpreted signals (be it their entry into overbought or oversold zones or divergence (divergence) from the price chart). Another thing is that these signals should be taken into account only under certain conditions (the most important of which is the absence of a pronounced trend), since in other cases they give a huge number of false signals;

2. Oscillators are essentially so-called leading indicators. This means that the signals received with their help are always slightly ahead of the market. That is, in other words, it turns out that when the oscillator gives its signal (for example, enters the oversold zone), the price chart does not yet react in any way. And only after some time does the price really begin to turn upward**.

** Provided that the oscillator signal does not turn out to be false

3. Thanks to modern trading terminals, oscillators can be configured for any financial instrument and almost any trading strategy. This becomes possible thanks to flexible settings of the initial parameters used when constructing indicators of this type.

Of course, in addition to the advantages listed above, oscillators also have a number of disadvantages, the most significant of which is a large number of false signals. Moreover, false signals can be given not only during the period of a strong trend in the market, but also at those moments in time when this trend is just beginning to form. In other words, looking at the price chart, you can be sure that there is a flat in the market, and rely on the readings of oscillators when making trading decisions. But in fact, at this very time a new trend movement will be formed (not yet visually distinguishable on the price chart) and the oscillators will give frankly erroneous signals.

Therefore, it is always recommended to use such a technical market analysis tool as oscillators in combination with other indicators (in particular, those that show the trader the presence and current strength of a trend).

In addition, the disadvantages of oscillator-type indicators include the lack of so-called ideal settings. That is, you cannot use the same oscillator settings for different financial instruments and, moreover, even for one specific financial instrument; they change depending on current market conditions. However, this drawback is inherent in almost any technical indicator.

Application

Beginning welders often try to light the welding arc by tapping or striking, even though this requires a lot of time and effort. Simplify your task, because the welding oscillator is specially designed to easily initiate an arc and weld non-ferrous metals. You can easily make high-quality and durable seams on parts made of stainless steel or aluminum. Oscillators are also installed on a welding machine designed for plasma cutting. The device can also be used when welding thin metals. It is enough to set the minimum current value in the inverter and connect the oscillator to the circuit. The arc will not be interrupted even at extremely low current values, which is especially convenient when welding continuous long seams.

Pulse devices

An oscillator is a device that is divided into two types. A device with pulsed power allows you to provoke its constancy at alternating current at the initial occurrence of an arc. When welding, fluctuations in the current used may occur, which can sometimes cause deterioration in the quality of work. To avoid this, the oscillators are synchronized.

Often, to excite a non-contact arc, pulse-type generators are used, which have accumulated reservoirs that are recharged from a special device. Taking into account the fact that the phase change of the welding current in the working process is not always stable, in order to organize reliable functionality of the generator, a device is required that synchronizes the discharge of the capacitance in cases where the current from the arc passes through zero.

Using alternating current, the oscillator is used for welding with both conventional electrodes and elements used to work with stainless steel, non-ferrous metals, and argon processing.