Current assets are assets of an organization that are regularly renewed. Necessary to ensure the activities of the company. They are one of the indicators of liquidity and management efficiency. The basic feature of mobile assets is their single or multiple turnover during the year or production cycle. They are distinguished by an increased turnover rate.

Question: How to reflect in accounting the costs of purchasing special equipment and putting it into operation if in accounting, special equipment is taken into account in the manner prescribed for accounting for current assets, and in tax accounting it is recognized as depreciable property? The special equipment was purchased for RUB 240,000. (including VAT 40,000 rubles) and put into operation in the month of purchase. The useful life of special equipment belonging to the second depreciation group in accounting and tax accounting is set equal to 25 months. According to the accounting policy, for accounting purposes, repayment of the cost of special equipment accounted for as part of current assets is carried out in a straight-line manner, starting from the month of transfer to operation. Interim financial statements are prepared as of the last day of each calendar month. For tax accounting purposes, income and expenses are accounted for on an accrual basis; depreciation is calculated using the straight-line method. View answer

Composition of current assets

Knowledge about mobile assets meets the management goals of the enterprise. The manager must have information about the company's performance indicators and ratios. The source of obtaining this information is financial statements. Most of its accounts are devoted to operations related to working capital. Let's look at the composition of mobile assets:

- Various supplies: raw materials for production, products.

- VAT charged on purchased items.

- Accounts receivable.

- Financial contributions.

- Cash and cash equivalents.

Mobile assets are reflected in the second section of the balance sheet.

How to fill out line 1260 “Other current assets” ?

What does specific gravity show?

As already mentioned, specific gravity shows the influence of one part on the whole object. For example, if an indicator of production costs is calculated, it can be used to understand where the company spent more money during the production of goods.

The indicator is also used to identify output per employee, per team and per workshop. To do this, the quantity of products produced by a calculation unit (an employee, a group of specialists or a department) is divided by the total number of goods manufactured and multiplied by 100. In this case, the specific gravity reflects the quality of the work of the employee, team or workshop.

Specific gravity helps determine:

- quality of distribution of food supplies;

- efficiency of the enterprise;

- feasibility of spending funds;

- main sources of income and expenses, etc.

To identify the dynamics of the share in the economic development of an enterprise, it is calculated for each indicator by year. In this way, you can understand how the structure of the company's assets and liabilities has changed.

Why is mobile asset analysis required?

OA indicators are used to calculate some of the most important indicators:

- Profitability.

- Enterprise stability.

- Liquidity.

Question: How to calculate the amount of own working capital and the supply ratio based on the balance sheet? View answer

Mobile tools provide insight into a company's business activity. The analysis uses dynamic indicators. You can get them from the reporting. Financial stability is determined based on ratios. Verification of mobile assets is carried out using a reporting audit.

Indicators of current assets play an important role in the following circumstances:

- The need for credit . Working capital is one of the determining factors in lending. The bank, especially before issuing large funds, checks all financial indicators of the enterprise. Mobile assets can be used to secure loan obligations.

- Tax audits . Having records of current assets facilitates interaction with tax authorities. These indicators will help justify the occurrence of seasonal losses. Mobile devices often cause discrepancies between VAT deductions and VAT accruals.

Current assets are required by the enterprise manager. Indicators are the basis for drawing up a company development plan. They allow you to timely track all financial problems in the organization.

General definition

Economic indicators serve as micromodels of various phenomena in the financial activities of both the state in general and the business entity in particular. They are subject to various fluctuations and changes in connection with the reflection of the dynamics and contradictions of all ongoing processes; they can both approach and move away from their main purpose - assessing and measuring the essence of a particular economic phenomenon. That is why the analyst must always remember the goals and objectives of the research conducted using indicators for assessing various aspects of enterprise activity.

Among the many economic indicators compiled into a certain system, it is necessary to highlight the following:

- natural and cost, which depend on the selected meters;

- qualitative and quantitative;

- volumetric and specific.

It is the latter type of indicators that will be given special attention in this article.

Current assets ratio

The coefficient allows you to determine the number of transfers of mobile assets into cash and vice versa. It looks like this:

Cob = B / CCOA

The following values appear in the formula:

- Cob is the coefficient that you want to find out;

- B – revenue received during the year or other period;

- CCOA is the average cost of mobile devices for the analyzed time.

It is also advisable to calculate the average cost to obtain accurate results. The calculation is carried out using the following formula:

SSOA = (SOA0 / 2 + SOA1 + SOA / 2) / (N – 1)

The formula includes the following indicators:

- SOA0 is the working balance at the beginning of the time being analyzed;

- SOA1, SOA – balance at the end of similar periods of time under consideration;

- N – number of similar intervals;

- SSOA is the average price of mobile assets that needs to be calculated.

This method takes into account seasonal changes in balances, as well as the impact of external and internal circumstances.

ATTENTION! The resulting coefficient reflects only the general condition of the enterprise. More accurate values can only be obtained by having additional data: dynamics of coefficients, comparison with standard indicators.

Calculation example

The company received revenue for the year in the amount of 1,500,000 rubles. The average cost of mobile assets is 100,000 rubles. To calculate, you need to divide revenue by average cost. As a result, we get a coefficient of 15.

Example of specific gravity calculation

To better understand the process of determining the share of a company’s economic indicators, let’s look at an example based on:

| Economic indicator | Amount at the beginning of the reporting period, thousand rubles. | Amount at the end of the reporting period, thousand rubles. |

| Assets | ||

| Section 1: Non-current assets | ||

| NMA | 56,3 | 58,2 |

| OS | 125,63 | 125,63 |

| Long-term financial investments | 87,36 | 98,32 |

| Other noncurrent assets | 12,3 | 15,6 |

| Total for the section: | 281,59 | 297,75 |

| Section 2: Current assets | ||

| MPZ | 98,3 | 106,3 |

| VAT | 12,1 | 14,5 |

| Accounts receivable | 25,9 | 24,2 |

| Cash | 45,36 | 58,96 |

| Other current assets | 14,6 | 12,3 |

| Total for the section: | 196,26 | 216,26 |

| Total: | 477,85 | 514,01 |

| Passive | ||

| Section 3: Capital and Reserves | ||

| Authorized capital | 88,3 | 88,3 |

| Extra capital | 36,1 | 32,1 |

| Reserve capital | 55,3 | 34,2 |

| retained earnings | 56,2 | 65,3 |

| Total for the section: | 235,9 | 219,9 |

| Section 4: Long-term liabilities | ||

| Borrowed funds | 65,2 | 74,63 |

| Total for the section: | 65,2 | 74,63 |

| Section 5: Current Liabilities | ||

| Credits and loans | 96,3 | 125,69 |

| Accounts payable | 80,45 | 93,79 |

| Total for the section: | 176,45 | 219,48 |

| Total: | 477,85 | 514,01 |

Important! The income of the enterprise is reflected in the balance sheet as an asset, expenses - as a liability.

Calculation of the share of assets

First of all, let’s determine the share of current (UdVOA) and non-current assets (UdVVA) at the beginning and end of the reporting period:

UDVOA at the beginning of the reporting period = 196.26 / 477.85 * 100 = 41.07%:

UDVOA at the end of the reporting period = 216.26 / 514.01 * 100 = 42.07%;

UdVVA at the beginning of the reporting period = 281.59 / 477.85 * 100 = 58.93%;

UDVA at the end of the reporting period = 297.75 / 514.01 * 100 = 57.93%.

Now let’s find the specific weight for each asset:

| Economic indicator | Amount at the beginning of the reporting period, thousand rubles. | Amount at the end of the reporting period, thousand rubles. | Ud. weight at the beginning of the reporting period, in % | Ud. weight of the reporting period, in % |

| Section 1: Non-current assets | ||||

| NMA | 56,3 | 58,2 | 11,78 | 11,32 |

| OS | 125,63 | 125,63 | 26,29 | 24,38 |

| Long-term financial investments | 87,36 | 98,32 | 18,28 | 19,13 |

| Other noncurrent assets | 12,3 | 15,6 | 2,57 | 3,03 |

| Total for the section: | 281,59 | 297,75 | ||

| Section 2: Current assets | ||||

| MPZ | 98,3 | 106,3 | 20,57 | 20,68 |

| VAT | 12,1 | 14,5 | 2,53 | 2,82 |

| Accounts receivable | 25,9 | 24,2 | 5,42 | 4,71 |

| Cash | 45,36 | 58,96 | 9,49 | 11,47 |

| Other current assets | 14,6 | 12,3 | 3,05 | 2,39 |

| Total for the section: | 196,26 | 216,26 | ||

| Total: | 477,85 | 514,01 | 100 | 100 |

When calculating specific gravity, the result is often presented as a non-integer number. It must be rounded to the nearest hundredth. If after the hundredth the number is greater than 6, the last digit of the indicator is increased by 1.

Calculation of turnover in days

Turnover in days provides more information. To calculate, you can use the following formula:

Ob = K_dn / Kob

The formula uses the following values:

- About – turnover expressed in days;

- K_day – number of days in the analyzed period;

- Cob is the turnover ratio, the formula for calculating it is given above.

The obtained indicators should be compared with standard values. The latter can be installed by the enterprise independently. They are determined based on the following factors: contractual terms with partners, features of the field in which the company operates, territorial location.

Example

Let's look at the data from the example given earlier. The analyzed period is 300 days. The number of days is divided by a factor of 15. As a result, we get a turnover ratio of 20.

Methodology for determining the share in the economy

In economics, share is calculated using formulas. Calculations can be carried out using two methods: manually or using computer programs. In the first case, the accountant creates a table with economic indicators that make up one whole, for example, he groups all assets. At the next stage, he calculates the specific gravity for each characteristic and enters it into the appropriate window. As a result, each indicator has its own specific weight, expressed as a percentage of the total volume.

Important! To check the correctness of the calculations, it is enough to add up all the results of the specific gravity. If it turns out to be 100%, then the calculations were carried out correctly.

It is much easier to identify specific gravity using specialized computer programs. Today there are many electronic services created specifically for accountants. However, they are often purchased for a fee. To avoid unnecessary costs and reduce the time for calculating specific gravity, you can use the standard Excel program.

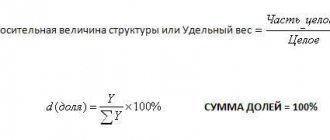

Formula for calculating specific gravity

To calculate the share in the economy, the general formula is used:

UdV = H/C * 100,

where UdV – specific gravity;

Ch – part of a whole object;

C – a whole subject.

The formula is used to calculate the share of all economic indicators, adjusting it to each of them. For example, the expression for determining the share of a company's income is as follows:

UDVD = VD / OSD * 100,

where UDV is the share of income;

Вд – the amount of receipts for one type of activity;

TSD is the total amount of the company’s revenue for all types of activities.

To apply the formula for calculating the share of other economic indicators, it is necessary to change the dividend to the determinable factor of the whole object and the divisor to the total amount of the instrument.

Determining Specific Gravity in Excel

To identify the share of economic indicators of an enterprise's activities, you can use the standard Excel computer program. It will help facilitate and speed up the calculation process. In addition, the risk of making mistakes is reduced.

To use an Excel spreadsheet to determine specific gravity, you only need to have basic programming knowledge.

What to do with the obtained coefficients?

The profitability of an enterprise is indicated by a coefficient exceeding one. The higher this value is, the greater the profitability of the company. You can increase the coefficients using the following measures:

- Increasing the competitiveness of products (improving quality, attractive design, expanding the sales market).

- Reducing product production time.

- Sales optimization.

To improve performance, it is important to carry out work at all stages of the enterprise’s activities. The manager's task is to increase the coefficient to the maximum. It is important to determine the value annually and compare it with last year’s indicators. Tracking dynamics provides objective data on the development of the company. Ratios can also be compared to industry averages of interest.

Share in the economy in simple words

The share in the economy is calculated to determine the influence of one part of the instrument on the entire item. In simple terms, an enterprise uses an indicator to determine how a particular fragment affects the overall condition. For example, if the total cost per unit is determined, then all expenses are classified and then it is determined what the company spends the most money on.

Take our proprietary course on choosing stocks on the stock market → training course

The share is also calculated when analyzing the overall financial and economic activities of the enterprise. In this case, the company's expenses and income are taken into account. Often, a balance sheet is used to identify the value of an indicator. Specific gravity is usually measured only as a percentage. Moreover, the whole item will always be equal to 100%.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Mobile asset structure

The structure of current assets is the ratio between the amount of current assets and fixed assets. Its formation depends on the following factors:

- Product liquidity.

- Taking into account existing risks.

- Type of activity of the enterprise.

Let's look at an example. The company is engaged in specifying legal services. Their execution does not require equipment or other material objects. Therefore, mobile assets will consist mainly of accounts receivable.

IMPORTANT! Standards for accounts receivable are determined depending on the size of accounts payable.

What's the result? Mobile assets are constantly changing. These are dynamic indicators that require regular calculations. Ratios respond immediately to external and internal changes. They allow you to track the efficiency of the enterprise at the moment of interest. The formulas for calculating them are quite simple. Current assets have different structures determined by the policies and activities of the enterprise. In one company the majority will be debt, in another it will be equipment. They are of interest not only to the manager, but also to banks and tax authorities.

Subject of specific weight in economics

The subject of specific weight in economics is any indicator that can be identified as a part of the whole. The subject is:

- Income. The company receives income from various types of activities. To understand which direction brings more profit, the share is calculated.

- Expenses. The enterprise spends funds not only on production, but also on other needs. The indicator is identified in order to determine the level of costs for a particular area of activity and the efficiency of spending money for each item.

- Assets. These include financial instruments through which the company makes a profit. As a rule, calculating the share of assets is necessary to determine the adequacy of the enterprise’s equipment and to track dynamics.

- Obligations. These include the company's monetary debts, including to suppliers and buyers, customers and creditors. The share of obligations is calculated to identify the significance of each of them and the degree of their influence on the costs of the enterprise.

- Production . To determine the profitability of the work of an employee, workshop and department, the specific gravity is calculated.

Important! The share can be identified for almost every economic indicator of a company’s activities.